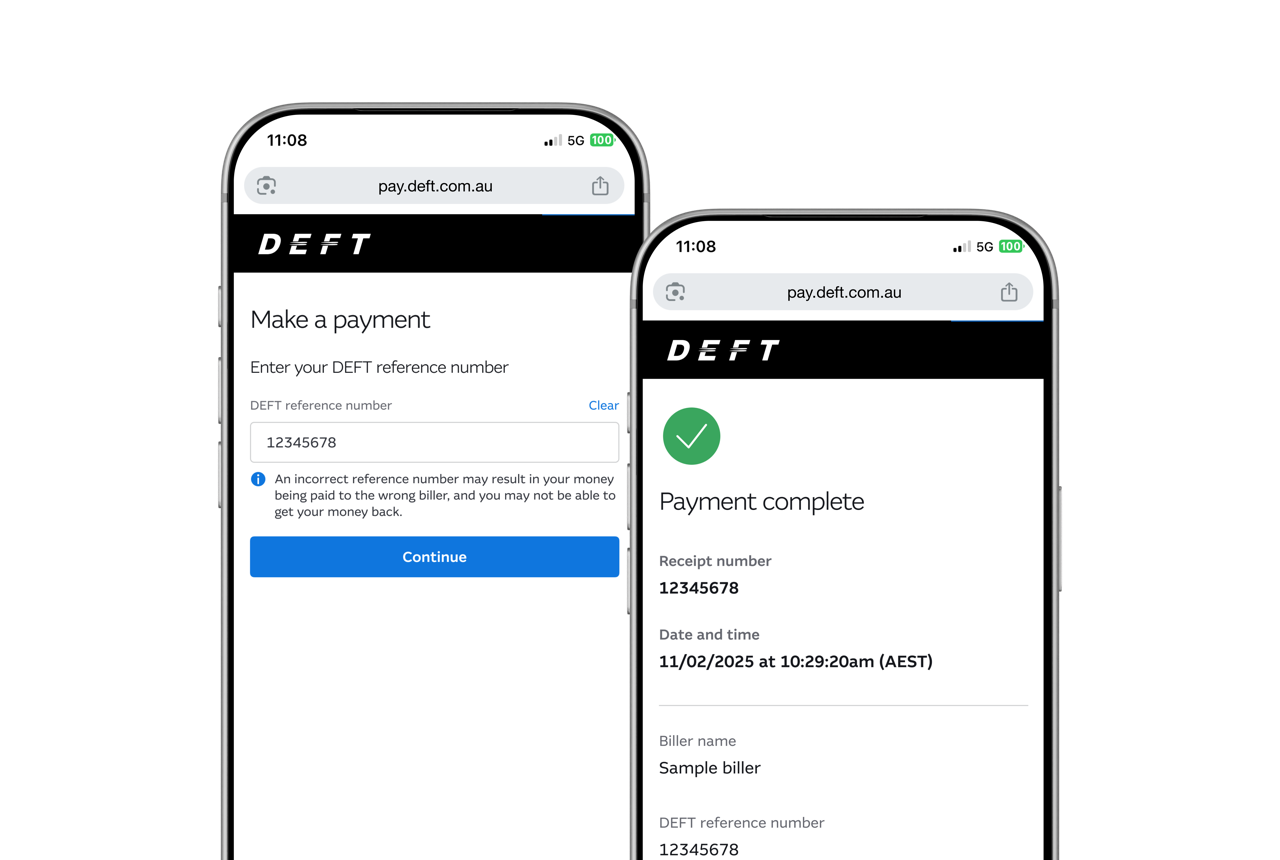

How to pay

To get started, ask your biller for your DEFT reference number. You can usually find this:

- For strata lot owners, on your levy notice.

- For renters, in your tenancy agreement or with your rental payment instructions.

- For other payments, on your invoice.

Ways to pay

Check with your biller what options are available to you. Transaction fees may apply to some payment methods – these are set by your biller and are shown before you pay.

Make a one-off debit or credit card payment

American Express, Mastercard and Visa cards accepted.

Transaction fees may apply.

PayID®

PayID is a fast and easy way to pay your bills. Ask your biller if they’re ready to start receiving PayID payments and read our simple instructions on using PayID for DEFT payments.

BPAY®

Ask your biller for a BPAY Biller Code. Use your DEFT reference number as the BPAY Customer Reference Number.

Make BPAY payments from your preferred bank account.

Australia Post

If you have a need to pay in person, ask your biller for a Post Billpay barcode.

Present your barcode at Australia Post to pay by eftpos or cheque.

Top tips to keep you safe when using DEFT:

- Look out for unusual requests from your biller, for example changes to accepted payment methods.

- If your biller provides updated payment details by email, obtain verbal confirmation that the request is genuine before making any payments to the new details.

- Always pay DEFT directly via one of the methods outlined above.

- Never make payments to intermediaries who may offer you a discount on your bill.

Need help?

Check our FAQs and read the DEFT Payer Guide.

Overseas +61 02 8550 5642

For billers

If you’re a business and want to accept payments via DEFT, visit our Payment solutions page.